Ever wondered what been going on behind the scenes when a brand new shopping centre pops up at the end of your street?

What is real estate investment banking?

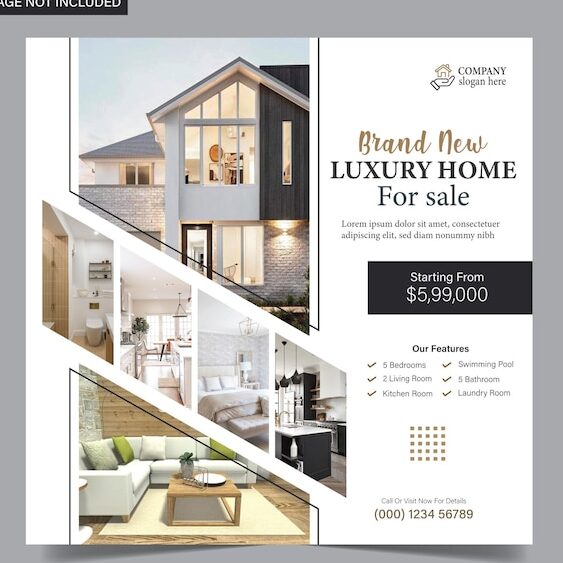

The term ‘real estate’ refers to property, i.e. buildings and/or land and everything on it. Could be hotels and luxury resorts, offices, homes, factories, developments, even things like casinos.

Investment bankers in this area will help their clients to buy and sell real estate, and develop it. The most common clients are real estate investment trusts (REITs) – trusts and companies that invest in real estate and pool together assets in the form of commercial properties and mortgages.

With transactions and deals worth millions of pounds and an impact on how our towns, cities and landscapes grow and develop around us, real estate is a rather exciting area of investment banking to work in. There’s a truly international dynamic: investment bankers regularly work on cross border transactions, or on financing for real estate development projects based in locations the world over.

Safe as houses

The investment bankers themselves usually cover two main duties. Firstly, they will provide advisory services to their clients looking to buy/sell land etc. (mergers and acquisitions), or develop it. They’ll provide guidance on the best ways for them to raise finances for their particular aim, highlight any potential risks and also make suggestions for potential real estate investment opportunities. Research analysts at the bank will carry out research into real estate opportunities across the world and monitor them; relationship managers and expert advisers will then present the most appropriate potential investments to their client for their considerations.

On the sell-side of real estate mergers and acquisitions, teams of investment bankers will represent their client to get them the best price for their asset, whether they’re selling the whole thing or equity (ownership in it). This regularly involves presentations, pitches and negotiations with potential buyers, or negotiations with a targeted buyer is talks between two parties have already kicked off. Confidence and an ability to be persuasive is therefore a must!

When it comes to sealing a deal, there can be many months of due diligence activities (exchange of various financial information documents) handled by analysts (the most junior members of the team) and associates before the deal is closed and the transaction is made. Organisational skills are very important here, with numerous requests and hundreds of documents flying about at any one time.

Secondly, investment banks will help their clients to raise finances – the cash/assets – which will enable them to do it, or else to fund a specific development project. They will manage things like long-term debt products for the client, like bonds or commercial mortgages, arrange syndicated bank loans (loans offered by a group of lenders rather than just one), help them to execute sales in equity (ownership in their own company) to help them get the capital they need. This is called ‘underwriting’.

A finance related degree (and at least a 2:1 result) is usually necessary for entry into the realm of real estate investment banking. If you can bag an internship in investment banking then all the better, as many of the big name investment banks will only consider you if you have this experience.

For years I have studied American finance regulations. All the information in this blog is sourced from official or contrasted sources from reliable sites.

Salesforce Certified SALES & SERVICE Cloud Consultant in February 2020, Salesforce Certified Administrator (ADM-201), and Master degree in “Business Analytics & Big Data Strategy” with more than 13 years of experience in IT consulting.